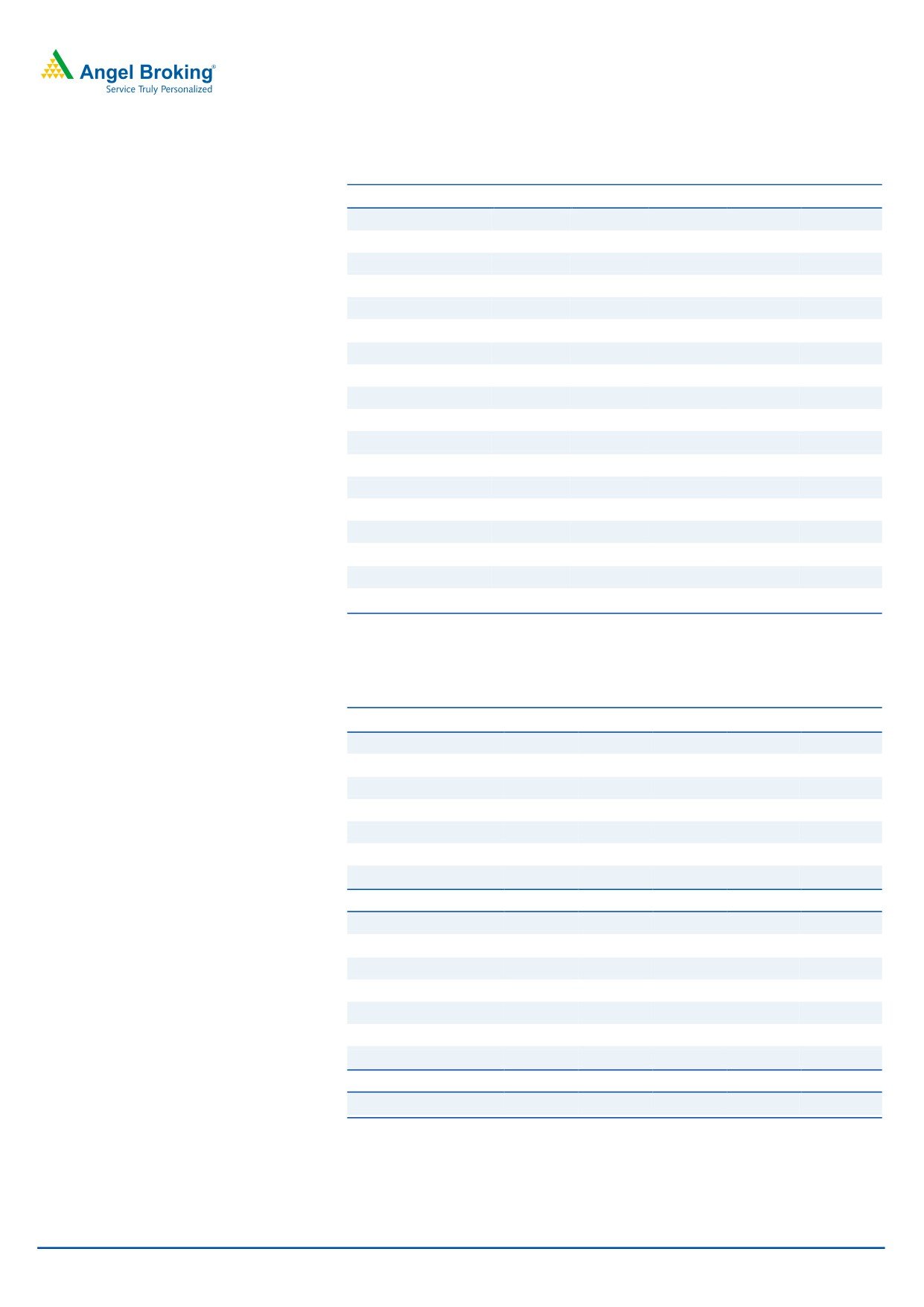

Q1FY2020 Result Update | Banking

July 31, 2019

Axis Bank

BUY

CMP

`674

Strong operating performance; new set of stressed loan disclosed

Target Price

`850

Particulars (` cr)

Q 1FY20

Q 4FY19

% chg (qoq)

Q 1FY19

% chg (yoy)

Investment Period

12 Months

NII

5,844

5,706

2

5,167

13

Pre-prov. profit

5,893

5,014

18

4,372

35

Stock Info

PAT

1,370

1,505

(9)

701

95

Source: Company, Angel Research

Sector

Banking

For Q1FY2020, Axis Bank reported PAT of `1,370cr, which is lower than our

Market Cap (` cr)

1,76,679

estimates owing to higher provision, however the positives were other income and

Beta

1.1

pre-provision profit surged by 35% yoy. Bank disappointed on asset quality front

due to (1) higher slippages, (2) addition to BB & below (`2,242cr), (3) exposure to

52 Week High / Low

827/543

new 8 stressed groups revealed.

Avg. Daily Volume

2,71,058

Provision, slippages surge; New set of potential stressed asset disclosed:

Face Value (`)

2

Provisions during the quarter increased by 41%/14% qoq/yoy primarily owing to

BSE Sensex

37,481

higher slippages and additional provision (land held as non baking asset and

Nifty

11,118

non fund based outstanding in NPA/ weak asset). Key disappointment was new

Reuters Code

AXBK.BO

list of potential stressed loan in 8 stressed corporate groups. Total exposure to

above corporate was `12,200cr of which `7,000cr was through advances,

Bloomberg Code

AXSB IN

`2,200cr through investment in bonds and non-fund based exposure worth of

`3,000cr (Exhibit 4). Out of this, exposure worth `6,700cr is not part of BB &

below book and NPA. However, bank has taken additional contingent provision

Shareholding Pattern (%)

worth `2,358cr over last few quarters. Overall stress asset (BB & Below+

SR+NFB) went up by 140bps qoq to 3.94%.

Promoters

17.6

Jump in other income, contained Opex aids pre-provision profit: During the

quarter, other income jumped by 32% yoy led by treasury gain worth `832cr, and

MF / Banks / Indian Fls

17.6

26% jump in core fee income supported by healthy growth (28% yoy) in retail

FII / NRIs / OCBs

52.1

fees. Opex grew at 3% yoy aided by rationalisation of outsourced services, digital

initiatives and lower promotion spends. Management expects Opex to remain

Indian Public / Others

10.1

contained for FY2020.

Retail loans drive momentum; NIM improved: During Q1FY2020, the bank’s

advances grew by 13% yoy, led by retail, up 22% yoy. However, overseas book

de-grew 34% yoy. NIMs improved by 11bps yoy (adjusted for one-offs) to 3.6%.

Abs. (%)

3m 1yr 3yr

Management guided NIM for FY2020 in the range on 3.5-3.8%. Deposit grew at

healthy rate of 21% yoy; however, CASA grew 7% yoy while declined 8%

Sensex

(2.1)

(0.1)

33.9

sequentially. CASA ratio plunged by 555bps/304bps yoy/qoq to 41%, however

Axis Bank

(9.2)

23.8

22.7

other banks are also witnessing decline in CASA ratio.

Capital Adequacy Ratio: Bank’s total CAR stands at 16.06% of which 11.68% is

CET-1; 45bps of capital was infused through conversion of warrants. During the

3-year price chart

quarter, 31bps CET-1 was absorbed by 2 RBI regulatory changes.

900

Outlook & Valuation: Axis Bank currently trades at 2x its FY2021E price to book

800

value (after adjusting value of subsidiaries). We expect the stock to get re-rated

700

owing to (1) new leadership, (2) limited stressed loan pool, and (3) improvement

600

in return ratios (ROA/ROE - 1.22%/14.2% by FY2021E). We recommend Buy on

500

400

the stock with a Target Price of `850.

300

Exhibit 1: Key Financials

Y/E March (` cr)

F Y17

F Y18

F Y19

F Y20E

F Y21E

NII

18,093

18,618

21,708

24,849

29,274

% chg

7

3

17

14

18

Source: Company, Angel Research

Net profit

3,679

276

4,677

8,273

11,940

% chg

(55)

(93)

1,596

77

44

NIM (%)

3.4

3.1

3.2

3.2

3.3

EPS (`)

14

1

18

32

46

Jaikishan Parmar

P/E (x)

57

763

45

25

18

Research Analyst

P/ABV (x)

3.9

3.7

3.3

2.8

2.4

022 - 39357600 Ext: 6810

R oA (%)

0.6

0.0

0.6

1.0

1.2

R oE (%)

7

0.5

7

11

14

Source: Company, Valuation done on closing price of 31/7/2019

Please refer to important disclosures at the end of this report

1

Axis Bank|Q1FY2020 Result Update

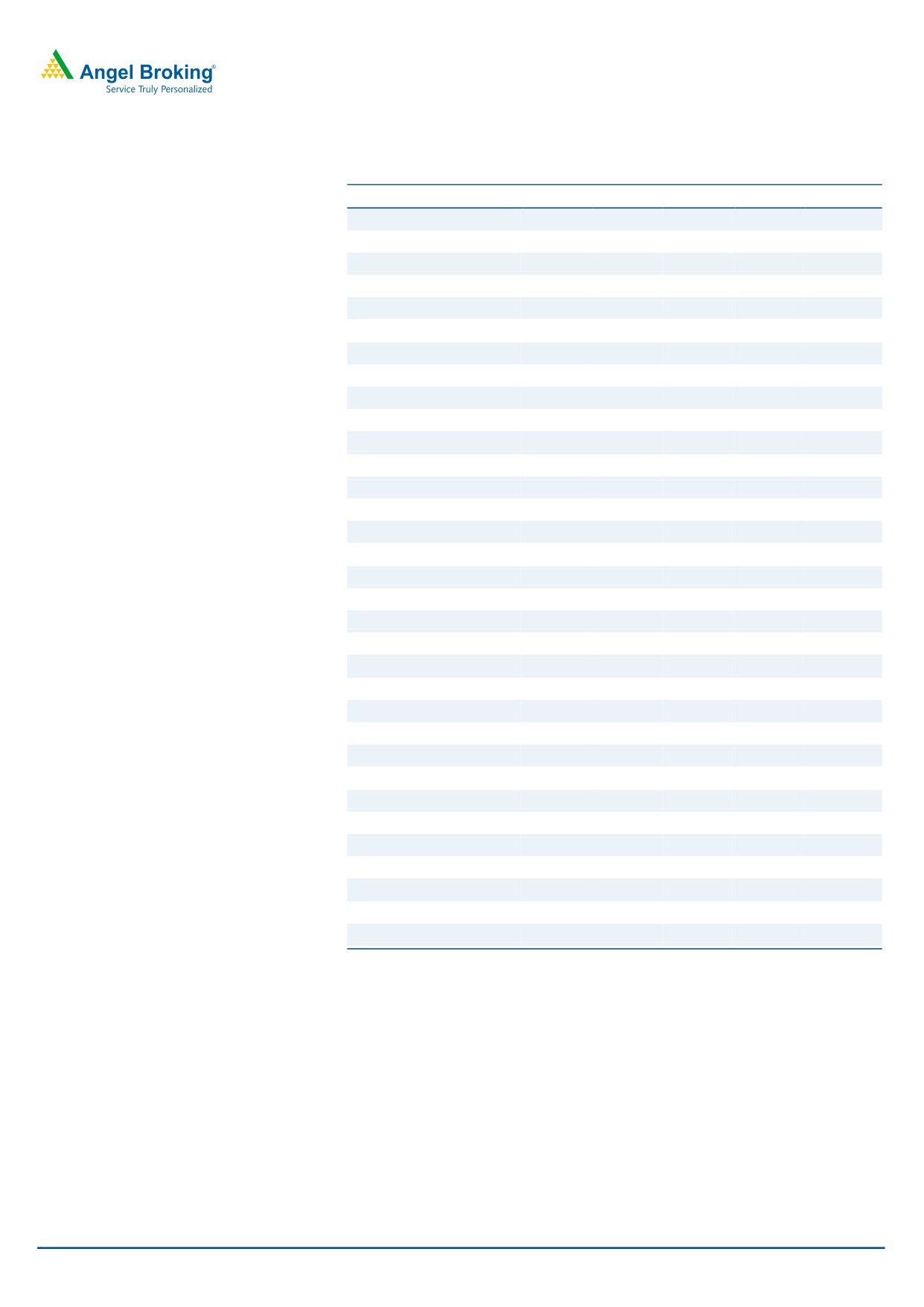

Exhibit 1: Quarterly Performance

Particulars (` cr)

Q 3FY18

Q 4FY18

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20% chg (qoq)% chg (yoy)

Interest Earne d

11,722

11,771

12,777

13,281

14,130

14,798

15,255

3

19

on Advances / Bills

8,768

8,753

9,612

9,955

10,628

11,127

11,461

3

19

on inve stments

2,559

2,574

2,682

2,802

2,894

2,971

3,119

5

16

on bal with RBI & others

81

108

125

162

183

224

192

(14)

54

on others

314

336

358

363

424

476

483

1

35

Interest Expended

6,990

7,041

7,610

8,049

8,526

9,092

9,411

4

24

Net Interest Income

4,732

4,730

5,167

5,232

5,604

5,706

5,844

2

13

Other Income

2,593

2,789

2,925

2,678

4,001

3,526

3,869

10

32

Operating income

7,325

7,519

8,092

7,910

9,604

9,232

9,712

5

20

Operating Expenses

3,471

3,847

3,720

3,816

4,080

4,217

3,820

(9)

3

Employee expe nse s

1,063

1,079

1,228

1,175

1,203

1,142

1,307

14

6

Other Opex

2,408

2,768

2,492

2,642

2,877

3,075

2,513

(18)

1

Pre.Prov Profit

3,854

3,672

4,372

4,094

5,525

5,014

5,893

18

35

Provisions & Contingencies

2,811

7,180

3,338

2,927

3,055

2,711

3,815

41

14

PBT

1,043

(3,507)

1,034

1,167

2,470

2,303

2,078

(10)

101

Provision for Taxes

316

(1,319)

333

377

789

798

708

(11)

112

Tax rate

30

38

32

32

32

35

0

PAT

726

(2,189)

701

790

1,681

1,505

1,370

(9)

95

Balance sheet

A dvance (` cr)

4,20,923

4,39,650

4,41,074

4,56,121

4,75,105

4,94,798

4,97,276

1

13

Deposit (` cr)

4,08,967

4,53,623

4,47,079

4,79,680

5,14,092

5,48,471

5,40,678

(1)

21

Credit-to-Deposit Ratio (%)

103

97

99

95

92

90

92

175.9bp

(668.4)bp

CA (` cr)

70,492

95,650

68,278

80,128

84,172

89,265

71,211

(20)

4

SA (` cr)

1,31,219

1,48,202

1,41,359

1,48,742

1,51,380

1,54,129

1,52,263

(1)

8

CASA deposits (` cr)

2,01,711

2,43,852

2,09,637

2,28,870

2,35,552

2,43,394

2,23,474

(8)

7

CASA %

49

54

47

48

46

44

41.3

(304.5)bp

(555.8)bp

CAR (%)

18

15

15

15

15

15

16.1

149bp

71bp

Tier 1 CAR (%)

14

12

12

12

12

11

12.9

163bp

104bp

Profitability Ratios (%)

Yield Advance

8.44

8.14

8.73

8.88

9.13

9.18

9.24

6.4bp

51.2bp

COF REPO

5.08

5.11

5.23

5.34

5.44

5.69

5.70

1bp

47bp

Reported NIM - Domestic

3.60

3.59

3.50

3.59

3.61

3.61

3.56

(5)bp

6bp

Cost-to-income ratio

0.47

0.51

0.46

0.48

0.42

0.46

0.39

(6.4)bp

(6.6)bp

A sset quality

Gross NPAs (` cr)

25,001

34,249

32,662

30,938

30,855

29,789

29,405

(1)

(10)

Gross NPAs (%)

5.28

6.77

6.52

5.96

5.75

5.26

5.25

(1)bp

(127)bp

Net NPAs (` cr)

11,769

16,592

14,902

12,716

12,233

11,276

11,037

(2)

(26)

Net NPAs (%)

2.56

3.40

3.09

2.54

2.36

2.06

2.04

(2)bp

(105)bp

PCR (%)

52

50

53

57

59

61

61

30.6bp

853.5bp

Slippage ratio (%)

1.1

3.8

1.0

0.6

0.8

0.6

1.0

35.6bp

(1.8)bp

Credit Cost on Adv (%)

0.7

1.6

0.8

0.6

0.6

0.5

0.8

21.9bp

1bp

Source: Company

July 31, 2019

2

Axis Bank|Q1FY2020 Result Update

Exhibit 2: Advance led by retail segment

Particular (` cr)

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20

% chg (qoq)

% chg (yoy)

Retail

2,11,648

2,21,710

2,32,397

2,45,812

2,58,205

5

22

Home Loan

84,659

86,467

90,635

93,409

98,118

5

16

Rural Lending

29,631

28,822

32,536

34,414

30,985

(10)

5

Auto Loan

23,281

24,388

25,564

27,039

30,985

15

33

PL

21,165

24,388

25,564

29,497

30,985

5

46

LAP

16,932

19,954

18,592

22,123

20,656

(7)

22

CC

8,466

8,868

11,620

12,291

12,910

5

52

SBB

6,349

6,651

6,972

7,374

10,328

40

63

Other

21,165

22,171

20,916

19,665

23,238

18

10

Corporate Banking

1,72,443

1,74,149

1,80,469

1,83,402

1,77,455

(3)

3

Term Loan

1,21,948

1,19,520

1,24,698

1,21,122

1,19,379

(1)

(2)

WC

50,495

54,629

55,771

62,279

58,076

(7)

15

S ME

56,983

60,262

62,238

65,584

61,616

(6)

8

Term Loan

12,348

12,496

12,846

13,475

12,757

(5)

3

WC

44,635

47,766

49,392

52,109

48,859

(6)

9

T otal

4,41,074

4,56,121

4,75,104

4,94,798

4,97,276

1

13

Source: Company

Exhibit 3: GNPA Movement; Slippages surged

Particular (` cr)

Q 1FY18

Q 2FY18

Q 3FY18

Q 4FY18

Q 1FY19

Q 2FY19

Q 3FY19

Q 4FY19

Q 1FY20

GNPA Opening

21,280

22,031

27,402

25,001

34,249

32,662

30,938

30,855

29,790

Fresh Slippage

3,519

8,936

4,428

16,536

4,337

2,777

3,746

3,012

4,798

Slippage

0.9%

2.2%

1.1%

3.8%

1.0%

0.6%

0.8%

0.6%

1.0%

Slippage Annul

3.7%

8.7%

4.2%

15.0%

3.9%

2.4%

3.2%

2.4%

3.9%

Upgrade & Recovery

306

1,048

4,008

3,401

2,917

2,186

1,622

2,376

2,177

Write off

2,462

2,517

2,821

3,887

3,007

2,315

2,207

1,701

3,005

Closing GNPA

22,031

27,402

25,001

34,249

32,662

30,938

30,855

29,790

29,406

Prov

12,265

13,350

13,232

17,657

17,760

18,222

18,622

18,513

18,367

NPA

9,766

14,052

11,769

16,592

14,902

12,716

12,233

11,277

11,039

Provision

2,342

3,140

2,811

7,180

3,338

2,927

3,055

2,711

3,815

CC

0.6%

0.8%

0.7%

1.6%

0.8%

0.6%

0.6%

0.5%

0.8%

CC Ann

2.4%

3.1%

2.7%

6.5%

3.0%

2.6%

2.6%

2.2%

3.1%

Source: Company, Angel Research

July 31, 2019

3

Axis Bank|Q1FY2020 Result Update

Exhibit 4: Non-NPL stress

Particular (` cr)

Q 1FY20

BB & Below rate d loans as on1QFY20

7,504

Non-Fund based stress pool (NFB to BB & Below & NPLs)

2,500

Security Receipt

2,940

T otal of existing stress (1)

12,944

New list (After removing overlap)

New loan addition (Exposure 7,000cr and 3,900cr considered in NPA & BB & Below)

3,100

New Non-Fund based addition (Actual 3,000cr and 1,000cr considered in NPA)

2,000

New Investment addition (Exposure 2,200cr and NPA/MTM taken 200cr/400cr)

2,000

T otal of new list (2)

7,100

T otal stress on loans (1)+(2)

20,044

Provisions on non-NPL stress

2,358

T otal stress loans

17,686

T otal stress loans (%)

3.56

Source: Company

Exhibit 5: SOTP

Valuation

Sum of the parts

Stake in Company%

Value/Share `

Methodology

Core Busine ss

100.0

2.5x F Y21E ABV

826.6

Axis Capital Ltd

100

15x FY21E PAT

9.8

Axis MF

75

20x FY21E PAT

3.7

Axis Fin

100

1.5x F Y21E Book Value

10.5

Axis Sec

100

15x FY21E PAT

5.2

holding value post 20% di sc

23.4

Sum of P arts

850

Source: Company, Angel Research, Valuation done on closing price of 31/7/2019

July 31, 2019

4

Axis Bank|Q1FY2020 Result Update

Income Statement

Y/E March (` cr)

F Y17

F Y18

F Y19E

F Y20E

F Y21E

Net Interest Income

18,093

18,618

21,708

24,849

29,274

- YoY Growth (%)

7

3

17

14

18

Other Income

11,691

10,967

13,130

15,180

17,409

- YoY Growth (%)

25

(6)

20

16

15

O perating Income

29,784

29,585

34,839

40,029

46,684

- YoY Growth (%)

14

(1)

18

15

17

O perating Expenses

12,200

13,990

15,833

17,566

20,304

- YoY Growth (%)

21

15

13

11

16

Pre - Provision Profit

17,585

15,594

19,005

22,463

26,380

- YoY Growth (%)

9

(11)

22

18

17

Prov. & Cont.

12,117

15,473

12,031

9,926

8,289

- YoY Growth (%)

227

28

(22)

(17)

(16)

Profit Before Tax

5,468

122

6,974

12,537

18,091

- YoY Growth (%)

- 56

(98)

5,637

80

44

Prov. for Taxation

1,788

(154)

2,297

4,264

6,151

- as a % of PBT

33

-

33

34

34

PAT

3,679

276

4,677

8,273

11,940

- YoY Growth (%)

(55)

(93)

1,596

77

44

Balance Sheet

Y/E March (` cr)

F Y17

F Y18

F Y19E

F Y20E

F Y21E

Equity

479

513

513

524

524

Reserve & Surplus

55,284

62,932

66,676

77,785

89,128

Net worth

55,763

63,445

67,190

78,309

89,652

Deposits

4,14,379

4,53,623

5,48,471

6,36,227

7,50,748

- Growth (%)

16

9

21

16

18

Borrowings

1,05,031

1,48,016

1,52,776

1,74,164

1,98,547

Other Liab. & Prov.

26,387

26,373

28,733

13,379

10,398

T otal Liabilities

6,01,559

6,91,458

7,97,169

9,02,079

10,49,345

Cash Balances

30,858

35,481

35,099

45,641

46,349

Bank Balances

19,398

7,974

32,630

13,119

15,386

Investments

1,28,793

1,53,876

1,74,969

2,00,132

2,28,648

A dvances

3,73,069

4,39,650

4,94,798

5,73,966

6,77,279

- Growth (%)

10

18

13

16

18

Fixed Assets

3,747

3,972

4,827

5,599

6,607

Other Assets

45,693

50,505

54,847

63,623

75,075

T otal Assets

6,01,559

6,91,458

7,97,169

9,02,079

10,49,345

- Growth (%)

11

15

15

13

16

July 31, 2019

5

Axis Bank|Q1FY2020 Result Update

Key Ratio

Y/E March

FY17

FY18

FY19

FY20E

FY21E

Profitability ratios (%)

NIMs

3.43

3.13

3.16

3.16

3.25

Cost to Income Rati o

41

47

45

44

43

RoA

0.6

0.0

0.6

1.0

1.2

RoE

7

0

7

11

14

B/S ratios (%)

CASA Ratio

51.4

53.8

44.4

44.4

44.4

Credit/Deposit Ratio

90

97

90

90

90

A sset Q uality (%)

Gross NPAs

5.04

6.77

5.0

4.0

3.8

Net NPAs

2.11

3.40

2.3

1.6

1.5

Credit Cost

3.2

3.5

2.4

1.7

1.2

Provision Coverage

0.58

0.50

0.54

0.60

0.61

Per Share Data (`)

EPS

14

1

18

32

46

ABVPS (70% cover.)

204

218

241

290

333

DPS

5

5

5

5

5

Valuati on Ratios

PER (x)

48

641

38

21

15

P/ABVPS (x)

3.3

3.1

2.8

2.3

2.0

Dividend Yield (%)

0.8

0.8

0.7

0.7

0.7

DuP ont Analysis

FY17

FY18

FY19

FY20E

FY21E

NII

3.2

2.9

2.9

2.9

3.0

- Prov

2.1

2.4

1.6

1.2

0.8

Adj NII

1.0

0.5

1.3

1.8

2.2

Other Income

2.0

1.7

1.8

1.8

1.8

Total Income

3.1

2.2

3.1

3.5

3.9

Opex

2.1

2.2

2.1

2.1

2.1

PBT

1.0

0.0

0.9

1.5

1.9

TAX

0.3

-0.0

0.3

0.5

0.6

R oA

0.6

0.0

0.63

0.97

1.22

Leverage

10.5

10.8

11.4

11.7

11.6

R oE

6.8

0.5

7.2

11.4

14.2

Valuation done on closing price of 31/7/2019

July 31, 2019

6

Axis Bank|Q1FY2020 Result Update

Research Team Tel: 022 - 39357800

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Ang el or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and ot her reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may ari se from or in

connection with the use of this information.

Disclosure of Interest Statement

Axis Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

July 31, 2019

7